Bengaluru, May 5, 2022

Alternative Investments Wealthtech Platform ‘BHIVE.fund’ has raised strategic investments from Gruhas Proptech and Blume Ventures. Gruhas was co-founded by Nikhil Kamath of Zerodha and Abhijeet Pai of Puzzolana and is India’s largest proptech-focussed entity. Blume Ventures, a leading VC firm in the country today, counts multiple unicorns in its portfolio.

‘BHIVE.fund’ was set up by ‘BHIVE Workspace’, the oldest and one of the largest coworking and managed office players in Bengaluru. ‘BHIVE Workspace’ currently runs the largest coworking space in the city and will soon launch India’s largest coworking campus.

“This investment represents a significant milestone towards closing $1 million of Pre-Series A. We have term sheets and commitments to the ongoing Pre-Series A round which will be closing soon,” said Shesh Paplikar, cofounder & CEO of ‘BHIVE.fund’.

“We invested in ‘BHIVE Workspace’ through Blume Fund II in 2015. We have been closely working with Shesh and the team, and have been witness to the grit and resilience the team has shown through the pandemic. We are excited about ‘BHIVE Workspace’s’ new venture — ‘BHIVE.fund’. We continue to believe in the capability of this team to build robust biz. They have evolved to be solving the current real estate problem and are building a scalable business in an ever-growing commercial real estate market in India,” says Sarita Raichura, Vice-President, Blume Ventures.

The round also saw participation from prominent angel investors including Sreeram Reddy Vanga of Kofluence, Leadsquared founders Nilesh Patel and Prashant Singh, Kazi Arif Zaman, CFA, Partner at GestAlt Network and former MD of Everstone Capital, Partner of a prominent California VC firm, and NRIs from the US, etc.

“I have always been a big believer in Commercial Real Estate as an investment class. Technology is disrupting this segment and will bring in more investors through a fractional real estate mechanism. A similar model adopted by ‘BHIVE Workspace’ to the broader alternative asset class is set to grow big. I am very happy to come in as an investor and join Shesh & team on their journey,” expresses Sreeram Reddy Vanga, Investing-Founder, Kofluence.

‘BHIVE Workspace’ had, in 2021, raised a seed round from the likes of Madhusudan, Cofounder & CEO of KreditBee, Durgesh Kaushik Snapchat India and South Asia Head, Alok Bajpai, CFO, Adani Connex, who has also been a constant mentor and support, and others who confirmed their belief in ‘BHIVE Workspace’s’ vision. This US-headquartered company had also seen participation from over ten NRI investors.

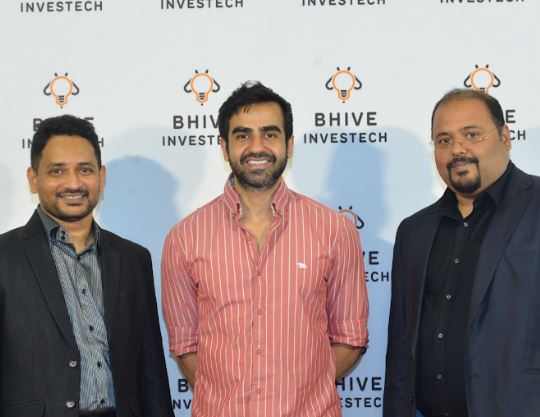

The ‘BHIVE.fund’ was founded in January 2021 by Shesh Rao Paplikar, Sandeep Gupta and Monnappa Bayavanda. The platform has already achieved product-market fit and has reached a sales run rate of a million dollars per month. Through the tech-driven platform, they enable individual investors to invest in business opportunities, domestic commercial real estate and international real estate.

“Nikhil and Abhijeet are big believers that huge disruptions are possible in the commercial real estate space using technology. While not all investors may understand this space well, Abhijeet comes with a wealth of experience and expertise in the commercial real estate sector, having been involved in many large deals. Nikhil, as we all know, is one of the biggest names in the wealth tech space. We are super excited to have them on board as strategic investors as we are looking to make this into something much much bigger,” says Shesh Rao Paplikar, co-founder & CEO, BHIVE Workspace.

“Blume Ventures has always been a very big supporter of us. They were the key investors of our previous startup which is into coworking. By making an independent investment into our fintech entity ‘BHIVE.fund’ they have shown great faith in the founders and the vision we have for the platform,” continues Shesh.

The company intends to utilize these funds for growth. Key usage will be towards building comprehensive technology to scale operations, building a strong investment team, educating customers on alternative asset space, etc.